How Do Mobile Money Fee Structures Impact the Poor?

Editors note: This blog is a cross-post from the CGAP blog

As mobile money products continue to expand within emerging markets, effective, pro-poor pricing for transferring small amounts of money will be important to mobile money’s success in bringing new users into the formal financial system.

Effectively targeted and appropriate pricing is critical to sustaining profitable models to deliver financial services to the poor. For customers, high fees and unclear or confusing pricing information are often cited as barriers to financial inclusion (for example, see Prina 2015 and Schaner 2015). For providers, competitive pressures, agent commission models, dynamics with strategic partners, and a host of other factors can drive pricing structures. Ultimately, every pricing decision has its trade-offs — for provider economics and strategic goals as well as for the well-being of a service’s most vulnerable customers.

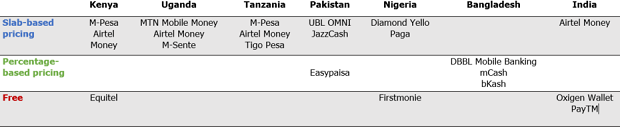

For researchers and policy makers to create solutions that expand the scope and impact of mobile money on low-income consumers, it is important to first understand the sheer diversity of mobile money pricing schemes, which can be a challenging task. Innovations for Poverty Action (IPA) recently compiled pricing details from 21 leading mobile payment products in seven countries, looking at the price of a single person to person (P2P) transfer between two users, including cash-in and cash-out.

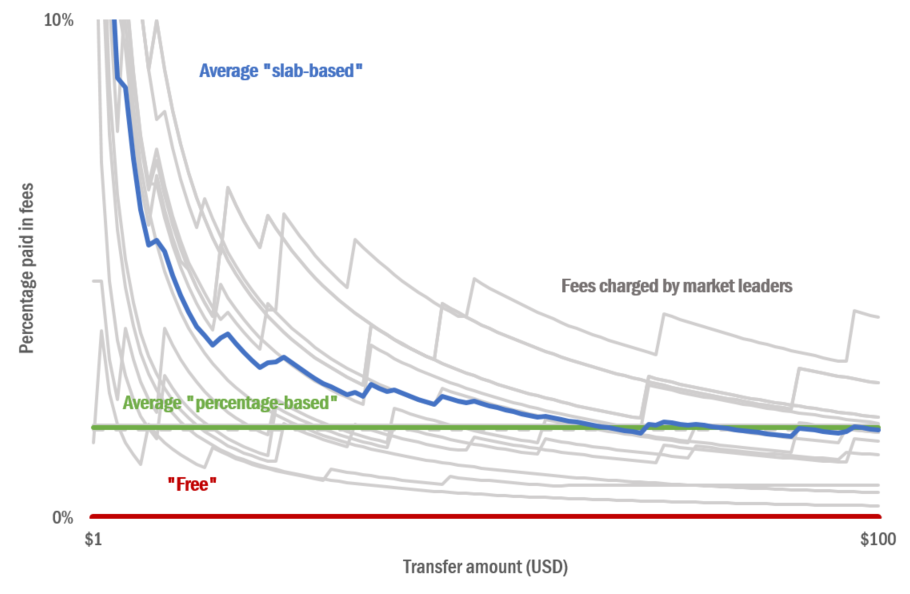

The types of pricing models observed can be broken into three categories: (1) slab-based pricing, where transactions within a predefined range are charged a flat fee; (2) percentage-based pricing, whereby the user pays a flat percentage of the amount sent, regardless of amount; and (3) free, with no transaction cost incurred by the user. Although there is significant diversity in pricing models, these data clearly show that the majority are regressive in some way, regardless of the market. In other words, the larger a customer’s transaction, the less they pay in percentage terms.

Mobile Money Products by Fee Structure Type

Mobile Money Fee Structures

Regressive pricing structures often mean that those with lower incomes, who are more likely to make small transactions, end up paying higher fees on a percentage basis. Digital financial services, such as mobile money, have the potential to provide the poor with affordable access to formal financial tools, but regressive price structures might limit the potential benefits for this segment of the population.

It is important to recognize that the structure, and not just the percentage consumers pay in fees to complete a transaction, may influence product demand and downstream welfare impact. While the cost of making small transfers is higher, there may be consumer protection benefits to using a slab pricing model, which is more intuitive than a percentage-based model, especially among individuals with low levels of numeracy. Agents can post easy-to-read tables for customers to see their fees before paying, which may remove a barrier to entry among new users. The drawback, again, is that slab pricing is most expensive on a percentage basis for the smallest transactions.

Moving forward, more research is needed to understand how consumers react to different pricing models, as well as to identify best practices in effectively reaching customers at the bottom of the pyramid. We encourage providers to iteratively test and rigorously evaluate variations in these models in order to strike the right balance between financial sustainability, transaction volume and welfare impact.

Click on the Excel file attached to this post to download the original data and figures.