Evidence on Mobile Instant Credit

The digitization of financial services has enabled significant innovation in the provision of credit in low- and middle-income countries (LMICs), which some hail as a transformative development with potential to drive financial inclusion, reduce poverty, and spur economic growth. However, others associate digital credit with a proliferation of misconduct, consumer abuses, and over-indebtedness, which can have severe consequences for the most vulnerable consumers and amplify inequality.

Supported by the Bill & Melinda Gates Foundation, Mobile Instant Credit: Impacts, Challenges, and Lessons for Consumer Protection is a collaborative report from the Center for Effective Global Action (CEGA) and Innovations for Poverty Action (IPA) that aims to bring evidence and data to bear on this debate. In particular, it emphasizes the narrower topic of airtime loans and Mobile Instant Credit (MIC), small consumption-oriented digital loans where there is now a critical mass of impact evidence. We acknowledge this sector is dynamic and some evidence cited may already feel dated given the constant commercial innovation. Nevertheless, we hope this curation of relevant evidence and data contribute to a shared vocabulary, reference base, and conceptual framework that advances the discussion on the relationship between the digitization of credit and development.

What is Mobile Instant Credit?

Digital credit has rapidly expanded over the past decade and now includes many types of loan products. We focus on airtime loans and Mobile Instant Credit (MIC). MIC generally refers to small, short-term consumption-oriented loans that are remotely and rapidly disbursed, offering borrowers access to funds even without a formal credit history. MIC and airtime loans are among the most popular products from the first generation of digital credit, which helped spur a growth in financial inclusion. As we evaluate evidence on these digital loans, it is important to consider whether and how they’ve expanded credit access for borrowers, as well as how the landscape is evolving.

Figure 1: Forms of Digital Credit

Digital credit has grown rapidly and now includes a wide variety of product types. A few examples excerpted from the full report are below:

|

Airtime Loans |

E-Commerce Buy Now, Pay Later |

Mobile Instant Credit |

| Small airtime advances for a fee | Unrestricted purchase divided into installments | Small, fast, mobile-enabled loans |

| To see the full list of forms of digital credit, download the full MIC report. | ||

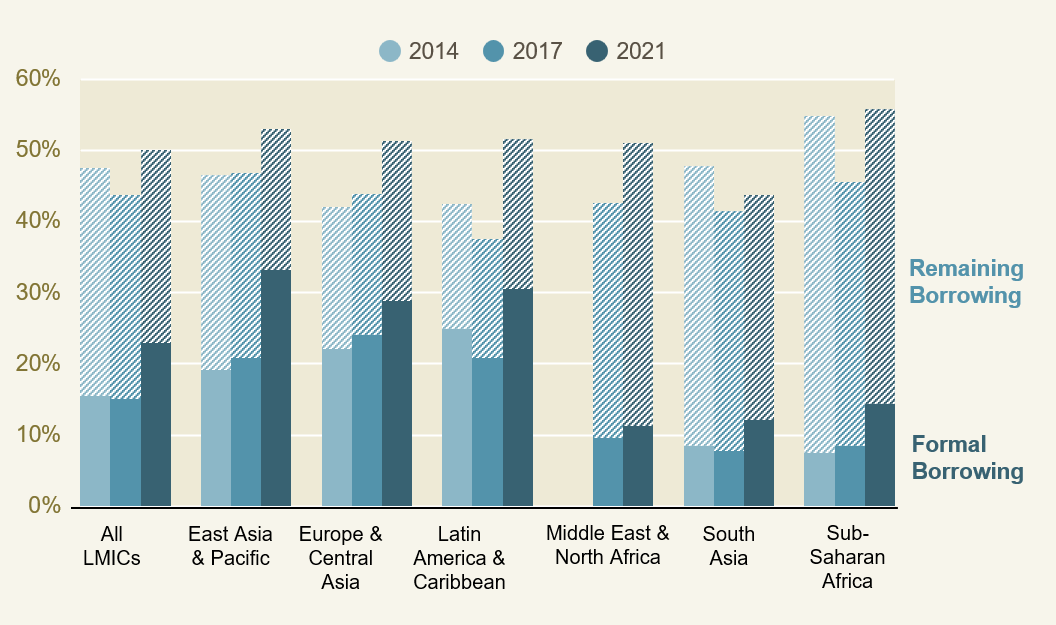

Although account ownership in LMICs grew from 55 percent in 2014 to 71 percent in 2021, formal borrowing still only accounts for a quarter of total borrowing. This means that the majority of customers still depend on less reliable, and possibly more costly, methods of financing. MIC offers attractive features of both formal and informal credit. While MIC has the speed of disbursement and flexibility of not requiring collateral and documentation like the informal lenders, terms of credit are relatively more reasonable, fair, and supervised by the Central Bank.

Figure 2: Formal versus Total Borrowing (% of Adults)

Across low- and middle-income countries, formal borrowing has risen as a percentage of total borrowing following increases in account ownership. Sub-Saharan Africa and South Asia have seen some of the largest percentage increases in formal borrowing, but still have much lower levels of formality than LMICs in other regions.

The popularity of MIC has helped the broader digital credit market grow and evolve quickly. Providers now offer products ranging from Buy-Now-Pay-Later (BNPL) and Overdraft Facilities for consumers, and are increasingly digitizing productive credit in sectors ranging from agricultural finance to e-commerce. Because of this, the report differentiates MIC within the digital credit ecosystem, and focuses on this product type where there is sufficient evidence to begin drawing conclusions. As digital credit continues to evolve, the insights from the report can inform digital credit-related policy more broadly.

Figure 3: Similarities and Differences between MIC and Informal Loans

| Similarities | ||

|---|---|---|

| Factor | Mobile Instant Credit | Informal Loans |

| Documentation and collateral | Usually not required | Not required |

| Speed of disbursement | Can be easy to obtain (automatic) | Can be easy to obtain (physical or automatic) |

| Loan amount | Small | Small |

| Differences | ||

| Factor | Mobile Instant Credit | Informal Loans |

| Medium | Digital, generally safer than cash | Typically cash |

| Regulation | May be regulated or unregulated, depending on provider and country | Unregulated |

| Reliability | High | Low |

| Interest Rates | Moderate to high, depending on provider and country | Generally high to very high |

| Repayment schedules | Strict | Flexible |

Key Insights

Limited Impacts of Digital Credit

Digital credit first launched in 2012 and has helped catalyze a large growth in formal financial inclusion. Despite rapid adoption, evidence suggests that digital credit has had a limited impact on welfare. Studies thus far have only found evidence of modest improvements in subjective well-being. While digital credit has not had transformative effects, causal studies have not found evidence it is harming the average consumers’ financial health, ability to save, or overall spending. This counters fears that easy access to credit may be leading to widespread over-indebtedness and fraud, and provides optimism for digital credit’s potential.

Urgent Challenges

The proliferation of digital credit creates urgency for addressing consumer protection challenges, including high and hidden fees, over-indebtedness, post-contract exploitation, fraud, and discrimination. Although rigorous evaluations have not found negative impacts for the average consumer, there is robust descriptive evidence that risks are on the rise. This is particularly true for low-income consumers with little to no prior experience with formal financial services, among whom MIC and airtime loans are popular. For example, in Kenya, the first country to broadly introduce mobile instant credit, one report found that 3.2 million Kenyans had been negatively listed by Credit Reference Bureaus (CRBs) by 2020, with the majority of defaults linked to mobile digital loans.

Promising Solutions

Although consumer protection risks are on the rise, new approaches to market monitoring and empowering consumers have shown promise in pilots and causal studies. Regulators may be able to move towards lower-cost, more responsive market monitoring approaches using new data sources and collection methods, along with advanced data analytics. Further, interventions and policy solutions directly targeting consumer and provider behavior have been effective at improving loan repayment, reducing debt stress, and protecting data privacy.

Insights for Policy and Practice

Digital credit is growing and evolving rapidly, with potential to enable growth as reduced costs, faster underwriting, and better information on prospective borrowers may lead to more suitable and sustainable products, particularly in more productive parts of the economy. However, there are clear dangers to maintaining the status quo in unregulated or underregulated markets. Whether the next evolution of digital credit improves upon the first to provide less risky and more transformative solutions will depend on the evolution of commercial product design and public policy to monitor markets and protect consumers. Evidence on Mobile Instant Credit and airtime loans is particularly informative for emergent forms of consumer-oriented digital credit, such as Buy-Now, Pay-Later and overdraft products. However, the effectiveness of many forms of digital credit, particularly those focused on productive activities, remain unexplored, and regulatory frameworks are still being developed in many countries. More research is needed to understand who benefits from digital credit, and why.